When Americans think of “government social programs,” many imagine bureaucracies using taxpayer dollars to cut checks to poor people on “welfare” or to pay for Food Stamps. They do not think of student loans, the home mortgage interest deduction, or government subsidies to reduce the cost of employee health plans and retirement benefits. Yet such indirect social benefits channeled through the tax code or delivered as subsidies to private organizations have become at least as common as direct payments and services from government. Taken together, America’s many indirect social policies add up to the “submerged state,” a costly but hidden form of governance that has problematic consequences for U.S. society and democracy.

Are Submerged Policies Benefits or Tax Cuts?

Submerged programs are hard to understand because at first glance many of them look like tax cuts, not social programs. But they don’t cut taxes for all Americans across the board; instead they single out people in special circumstances and offer them extra assistance – just like direct programs such as Food Stamps, subsidized housing, and welfare. The difference lies in how the government help is delivered. Instead of sending out checks or providing services to people, these hidden policies reduce the amount owed in taxes by particular people or businesses.

The Home Mortgage Interest Deduction is a good example. Originally a minor footnote in the 1913 income tax, this deduction has ballooned into a costly entitlement. Politicians often speak of the mortgage deduction as a benefit for middle class Americans. But the vast majority of the benefit goes to affluent people who own expensive homes and itemize their tax deductions.

Submerged Benefits are Costly and Increase the Federal Deficit

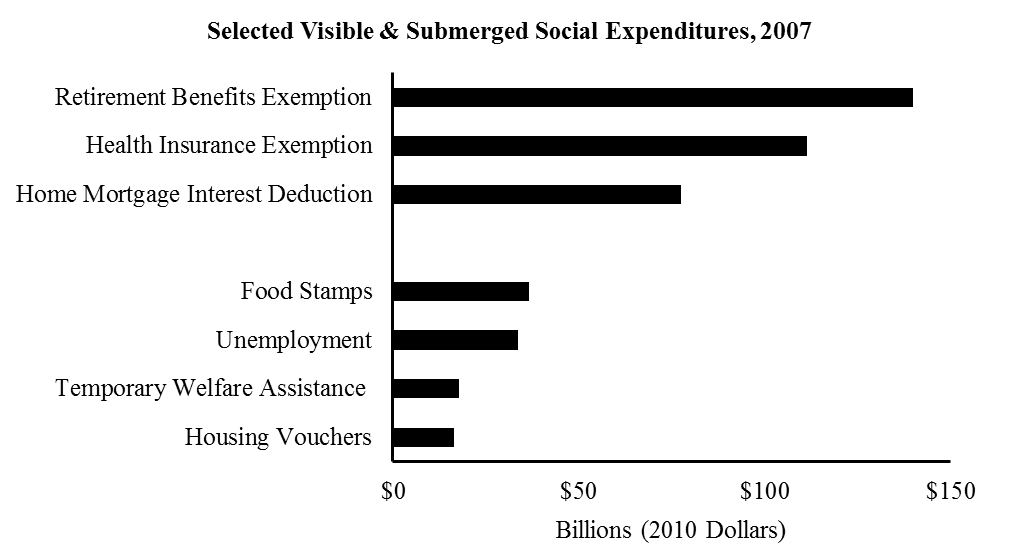

The cost of hidden social welfare benefits in the tax code adds up to $1.1 trillion per year, about 7.4% of the Gross National Product (GDP). These hidden benefits for households are more costly than corporate tax breaks, which cost less than 1% of GDP; and they also cost more than Social Security, equal to about 5% of GDP; or Medicare and Medicaid combined, which also cost about 5% of GDP. The huge cost means fewer resources to pay for much-needed programs that would do more to help lower and middle-income Americans.

Hidden Social Welfare Makes America More Unequal

Many people think that ordinary Americans get the most help from social welfare benefits. But the costliest submerged benefits primarily help the wealthy. Consider the three most expensive benefits hidden in the tax code – for the mortgage interest deduction and tax credits for employer retirement and health plans. The richest 15 percent of all U.S. income-earners get more than two-thirds of the value of the mortgage deduction, more than half of the value of subsidies for employer retirement plans, and almost a third of the value of subsidies for employer health benefits.

Hidden expenditures are not fair to businesses either. Some industries and firms get tax breaks and subsidies, while others get nothing or very little. That distorts fair market competition.

Hidden Benefits Empower Vested Interests and Undermine Democratic Reforms

Indirect social spending frustrates democratic accountability:

- Keenly aware of gains from hidden benefits, privileged groups curry favor with politicians on both sides of the aisle and make generous campaign contributions in every election. Lobbyists for hidden benefits influence policymaking far from public view.

- Ordinary citizens know little about hidden subsidies and tax breaks. Policymakers do not talk about them and the extra help they give the well-off. Even when pivotal reforms are at stake, most Americans do not make their voices heard, and special interests carry the day.

- Citizens left in the dark cannot criticize or reward elected leaders. During 2009 and 2010, for example, the Obama administration extended new benefits to the middle class and reformed student aid and health programs to deliver more help to ordinary families. But most Americans did not notice – because most of the action happened in hidden programs.

Through better policy design and communication, America’s political leaders can make it easier for citizens to perceive government’s true role in their lives. Experimental research shows that even small amounts of information can help citizens decide which programs meet their values and needs. The submerged state can also be made a lot fairer – by limiting benefits going to the wealthy to levels that never exceed benefits delivered to middle-income Americans.

Read more in Suzanne Mettler, The Submerged State: How Invisible Government Policies Undermine American Democracy (University of Chicago Press, 2011). Data soruces for the figure above appear in this book, Figure 1.5, page 22.